The Invisible Web of Copper: A Day in the Life

- Anna Dalaire

- Sep 6, 2025

- 5 min read

Let's tally up the copper I used before lunch. My phone alarm rings, the device’s 8 grams of copper silently at work. I stumble out of bed and flip on the light switch, copper wiring illuminating the room. Heading to the bathroom, I plug in my curling iron and blow dryer, their heating elements humming with copper. The TV in the living room flickers to life, delivering the morning news via a copper-based signal.

I brew my coffee, copper coils heating the water. I sit down at the kitchen table to answer a few emails on my laptop, another collection of copper circuits. I press the down button for the elevator in my building, which glides on copper-powered motors. Finally, I get into my Uber, pull out my iPhone, and check on an AI query.

In that short time, I touched an invisible web of copper that was silently at work, powering my day. It’s the "shadow price" of copper in my life: invisible, but everywhere.

Before I even logged into my first meeting, I consumed a surprising amount of copper. My alarm clock is powered by a device containing 8 grams of copper.

My hair dryer and curling iron each hum with about 50 grams of the metal in their heating elements and cords, while my coffee machine's heating coils add another 100 grams.

All the lights I turned on, the laptop I opened, and the TV that delivered the morning news relied on the approximately 195 pounds of copper wiring in the average U.S. home.

The elevator I took downstairs is moved by a motor and cables containing hundreds of pounds of copper, and even my gas-powered Uber includes 20 kg of the metal.

That's nearly 200 kilograms of copper woven invisibly into the things I touched before my first meeting.

The Tech & AI Surge

The copper story isn’t just about EVs and renewables anymore. It's also about a new wave of technology demanding more from the grid than ever before. Data centers, cloud connectivity, and everyday devices all rely heavily on copper.

Data Centers: The AI boom is driving the construction of copper-intensive server farms equipped with processors, cooling systems, and massive power supplies.

Cloud & Connectivity: Every Zoom call, Netflix stream, or ChatGPT query relies on copper cabling in local networks and long-distance grids.

Devices: Smartphones, laptops, and wearables continue to climb in unit sales, each carrying grams to kilograms of copper inside.

When you check Slack, order an Uber, or run an AI query, you're leaning on a copper backbone stretching from your charger to hyperscale data centers.

The Demand Multiplier

Copper demand isn't just growing; it's compounding. The global push toward electrification and data processing acts as a powerful multiplier.

EVs: Require 2–4x more copper than internal combustion engine vehicles.

Renewables: Wind turbines (~4 tons each) and solar installations (5.5 tons per MW) are highly copper-intensive.

AI & Data: Each hyperscale data center requires tens of thousands of kilometers of copper cabling.

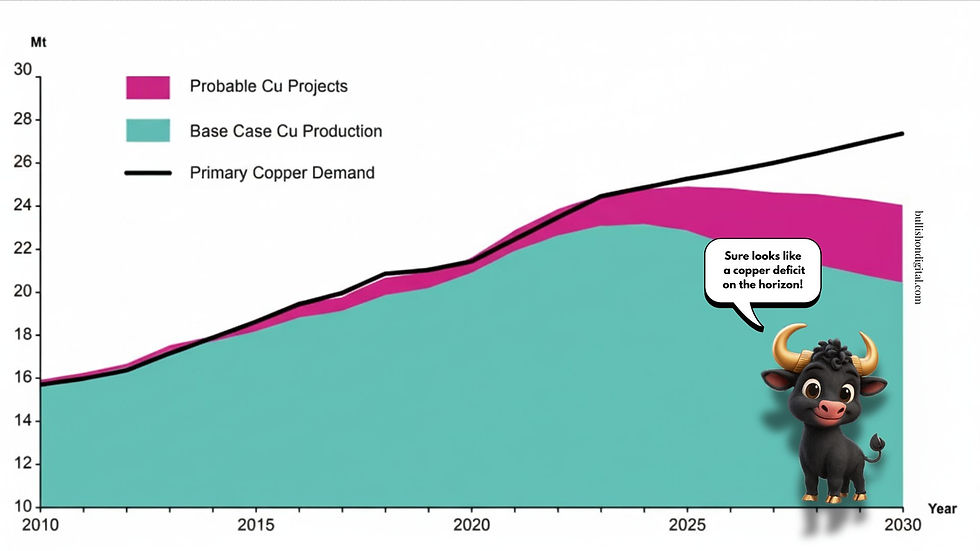

Forecasts indicate that copper demand will rise from 28 million tonnes (Mt) in 2020 to over 40 Mt by 2040. In aggressive electrification and AI scenarios, deficits of 6 Mt or more per year could emerge by the early 2030s.

But as demand skyrockets, a serious question remains: can the supply keep up?

The Supply Squeeze

Copper supply can’t just flip a switch. The world is facing a looming supply crunch due to several critical factors.

Time to Market: It takes 15–20 years to go from a copper discovery to a producing mine.

Declining Ore Grades: Today’s mines yield less copper per ton, which raises costs and presents technical challenges.

Geographic Risk: Over half of the world's copper reserves sit in just five countries: Chile, Peru, Australia, the DRC, and Russia.

Underinvestment: Exploration budgets have been lagging for a decade, leaving the project pipeline dangerously underdeveloped.

To meet demand by 2040, analysts estimate that the world needs 80 new large copper mines in the next decade, at a staggering cost of over $250 billion.

How Exploration Impacts the Invisible Web of Copper

Why Exploration Matters

This is precisely why exploration is critical. Junior miners are the seed corn of tomorrow’s supply. Every drill hole, geophysical survey, and permit shortens the gap between a "concept" and "copper in circuit boards."

Exploration projects feed the pipeline, allowing major companies to build mines. Without them, the EV revolution, AI boom, and renewable transition risk running into a bottleneck.

For investors, this presents an asymmetric opportunity. Quality copper explorers positioned in proven belts could be the lever points in the coming supply crunch. Their projects are the essential first step toward solving a global challenge.

The Real Takeaway

Copper is the hidden thread wiring your life, from your morning coffee to machine learning. When you ask ChatGPT a question on your phone while in an Uber, you’re tapping into an invisible copper web: from mines to smelters, wires, servers, and finally, your screen.

Demand is accelerating. Supply timelines are not. That gap is the 'shadow price' of copper, making exploration and mining one of the most critical and undervalued bets of our time.

----------

About the Author

Subscribe to Clicks & Capital to stay updated on my weekly content.

🎯 Small-cap visibility and investor trust, powered by storytelling and AI. Connect with Anna Dalaire and follow BullVision Consulting Inc. for more bold, compliant strategies.

Disclaimer: BULLVISION Consulting Inc. wrote and published this article for informational purposes only. My views are based on my experience in capital markets, communications, and small-cap exploration. While I strive to reference reliable, publicly available sources, I can't guarantee the accuracy or completeness of all information shared. This content is not investment advice, a recommendation, or a solicitation to buy or sell securities. Please do your diligence. Nothing here should be taken as legal, accounting, or tax advice, and I am not responsible for any decisions based on its content. This article is meant for a general audience and may not be appropriate for readers in jurisdictions where such material is restricted.

Sources

[1] Resource Capital Funds. Smartphone Technology relies on Metals and Minerals (2022). Link

[2] Copper.org. Copper Facts: Copper in the Home (n.d.). Link

[3] Giant Mining Corp. Copper in Electric Vehicles (n.d.). Link

[4] Sprott. Copper: Wired for the Future (2023). Link

[5] Copper.org. Renewables (n.d.). Link

[6] Alaska Business. Copper Craze (2021). Link

[7] First Quantum Minerals. Meeting Growing Demands (n.d.). Link

[8] DNV. The Role of Copper in the Energy Transition (2023). Link

[9] UNCTAD. Global Trade Update (May 2025): Focus on critical minerals – copper in the new green and digital economy (2025). Link

Comments