The LinkedIn Strategy Every Small-Cap CEO Needs in 2025 to Raise Visibility and Capital

- Anna Dalaire

- Jul 27, 2025

- 7 min read

Are you overlooking your most powerful tool for investor visibility and trust?

In the competitive landscape of small-cap capital markets, where every advantage counts, are you overlooking one of the most powerful digital tools for investor visibility and trust?

LinkedIn, with over 1 billion users, has quietly become one of the most underutilized tools in small-cap capital markets. The platform's audience is highly educated, primarily employed, and possesses twice the buying power of the average online user. And yet, only 1% of LinkedIn members consistently post content. This single statistic should give you pause.

This is also followed by the fact that, in early 2025, the median engagement rate on LinkedIn rose to 8%, more than triple that of X (formerly Twitter), Instagram, or Facebook.

Translation? There's almost no competition, and massive upside for those who post well and often.

For small-cap executives, establishing trust online begins with a clear and consistent LinkedIn strategy. And in 2025, a strong LinkedIn strategy for small-cap CEOs should no longer be considered optional; it’s the fastest way to stand out in a crowded market.

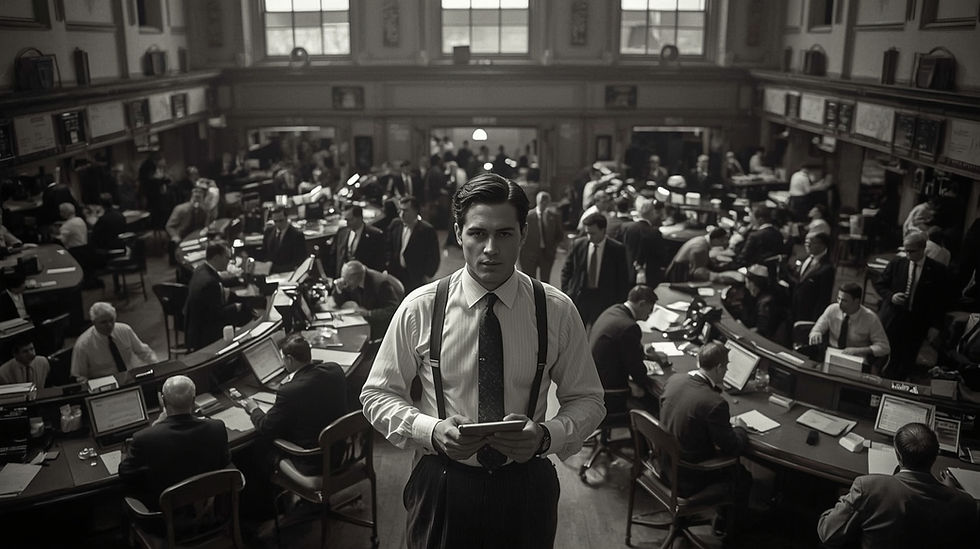

Capital markets haven’t changed as much as we think. Investors still chase confidence. The difference is where it’s built. In the 1920s, visibility meant showing up on the trading floor. Today, it means showing up in the feeds. Authority isn't only earned in closed rooms anymore; it’s built online, through consistent, strategic content.

If you’re not building your digital footprint, you’re invisible to the world where over 80% of investor spend their time.

Why a LinkedIn Strategy for Small-Cap CEOs Matters Now

Research shows that 82% of Americans believe companies are more influential when their executives are visible online.

Meanwhile, CEO-led posts get up to 561% more engagement than company page posts.

Investors don’t just back balance sheets. They back people they trust. And if they can’t find you online, they’ll move on to someone they can. They want to see who's leading the company and whether that person shows up with confidence, competence, insight, and relevance.

The smaller the market cap, the more trust and visibility matter. Without name recognition or big-budget IR campaigns, executive visibility isn't just nice to have; it's a strategic advantage.

A founder or CEO who consistently shows up online can:

Stand out from 100+ peers in the same commodity

Establish a narrative that investors can follow between news cycles

Humanize the business and attract partnerships, capital and talent

In the past, credibility was often associated with titles, suits, and in-room presence. Now it’s built through how often and how clearly you show up online. The trust you used to build across a table? Now, it starts with your headline and first post.

Cracking the Code: What LinkedIn's 2025 Algorithm Rewards

In 2025, LinkedIn’s algorithm prioritizes value-driven, well-structured content, particularly from individuals, rather than brands. Despite its scale, the network remains underused mainly by consistent and niche content creators, which gives standout posts a clear path to rise faster and farther.

Content that sparks early engagement, particularly comments, is amplified by the algorithm. If a post gains traction within the first 60 minutes, it’s pushed beyond your immediate circle to second- and third-degree connections, dramatically expanding its reach.

Some other shifts to note:

Video consumption increased 6× between July and October 2024

Employee content earns 2× the clicks of corporate posts

Thought-leader content from execs has a 2× higher click-through rate compared to company posts

Strategy Over Volume: How Often (and When) to Post for Impact

LinkedIn rewards consistency, but that doesn't mean posting to fill space. The target should be daily posting. The minimum is three strong, relevant posts per week.

To achieve traction, you need to be predictable. Investors and industry peers should come to expect your voice, just as they expect quarterly earnings reports.

That said, don't overpromise and don't disappear. Three thoughtful posts are far more valuable than six generic reshares or off-topic memes. You can be funny, but if every post is a joke, no one is taking your leadership or your company seriously.

Set a schedule you can sustain. In the old world, people remembered who spoke up in the room. Today, they remember who shows up consistently in the feed. Your visibility isn’t about shouting, it’s about rhythm.

Visibility compounds with consistency, not just volume.

What About Timing?

You'll often hear that Tuesday mornings or Thursday afternoons perform well. That's a reasonable starting point. But the real strategy is knowing when your specific audience is online.

Use LinkedIn's native analytics to study engagement patterns. Look closely at which posts perform best and when they do so. Those patterns will reveal your optimal posting times. Your job isn't just to show up. It's to show up when your audience is paying attention.

Content That Converts: Formats That Resonate on LinkedIn

Not all content is created equal. Data shows these formats outperform across industries.

Text posts: Lead with a concise 2–3 line hook that sparks curiosity. A visible "See more" expands your reach.

Native video: Short (1–3 min) clips explaining key updates or insights can yield 5× the reach of text posts.

Carousels: Uploading a PDF as a post (especially a step-by-step explainer or case study) increases dwell time and improves the algorithm's performance.

Polls: Not every post needs to be a TED Talk. Smart polls spark easy engagement but skip the “What's your favorite breakfast cereal” nonsense.

Newsletters: Ideal for long-form insights and SEO—but they should complement, not replace, short content.

Your LinkedIn Profile: More Than a Resume, It's a Credibility Magnet

If your LinkedIn profile reads like a résumé, you're already being overlooked. Visitors should immediately understand what you do, who you help, and how you solve problems. If your profile headline says “President, XYZ Minerals” and nothing else, you're wasting space. Tell people why they should care. Tell them what you fix.

Your profile is not about career highlights. It's about positioning. What do you bring to the table? What kind of investor, client, or partner should connect with you, and why?

Start with a professional photo and a headline that clearly communicates your value. Your summary should speak directly to your audience. Focus less on where you've been and more on how you make other people's lives easier, businesses stronger, or decisions clearer.

Make sure your profile aligns with your company's message. A disconnect between what you say on LinkedIn and what appears in your Business page, press releases, website, or investor presentations creates confusion, and confusion kills trust.

End your profile with a clear next step. Whether it's booking a call, subscribing to your newsletter, or reviewing your latest investor deck, give people a reason to act.

A strong profile doesn't just look credible. It tells the right people they've found the right person.

Curating Your Connections: Building a High-Impact LinkedIn Network

LinkedIn prioritizes content that's relevant to the reader. That means your connections matter.

Don't try to amass followers. Instead, build a curated network of small-cap peers, bankers, analysts, journalists, and investors. You want your content to reach the people who can move your business forward. This isn’t about collecting followers like they’re baseball cards. It's about building the right audience and earning their attention.

Use the "Dream 100" approach: instead of chasing the big names, connect with their network by commenting on their posts, tagging them, or attending their events.

Beyond Posting: Amplifying Your Content Through Strategic Engagement

Posting is only half the job. The LinkedIn algorithm rewards creators who actively engage with others. Spend 10–15 minutes before and after posting to comment on relevant content. Meaningful engagement not only boosts your visibility; it also positions you as a thought leader in someone else's feed.

Respond to every comment on your posts. Don’t leave your audience hanging. A like is polite. A reply builds trust. The more conversations you spark, the more people will see you and remember you.

The Long Game: Leveraging LinkedIn for Lasting Audience Ownership

LinkedIn is your top-of-funnel asset. However, owning your audience matters more in the long term.

Use your LinkedIn momentum to drive followers into your email list.

Create lead magnets like:

Investor guides

Educational eBooks

Market explainers

Tools like Mailchimp, ConvertKit, or Beehiiv can help you build and nurture a list. Remember: an email subscriber is worth more than a social follower because you can reach them directly, without an algorithm dictating visibility.

And if you're already appearing on podcasts, panels, or webinars? Repurpose that content. Chop it into clips. Summarize it into a newsletter. Turn it into quote graphics. This builds your pipeline and reinforces your authority.

Navigate with Confidence: Staying Compliant in Your LinkedIn Strategy

None of this requires breaching material disclosure or offering investment advice. Speak to your expertise. Comment on trends. Break down the news in your sector. Always clarify that you're sharing an opinion, not forecasting results.

And align your social activity with your IR strategy. If your earnings call says one thing and your personal LinkedIn says another, investors notice. Brand trust is fragile. Keep it cohesive.

Final Word: Visibility = Trust = Capital

In 2025, LinkedIn is no longer optional for small-cap leaders; it's a lever. The platform is undersaturated, over-performing, and waiting for thoughtful, consistent content from people who know their stuff.

You already have the expertise. What you need now is visibility. Because in a market that's always moving, the brands investors remember are the ones that show up.

It’s not about rewriting the rules. It’s about understanding the new arena. The same trust investors used to build in private, they now make on social media. The format changed. The stakes didn’t.

Ready to turn your expertise into real visibility and start driving attention and credibility for your small-cap company? I'm developing a targeted program for executives seeking to leverage personal branding to attract investors' attention, establish trust, and differentiate themselves online.

Think: investor-ready content, CEO-led strategy, and AI tools that work while you sleep.

Want in early? DM me on LinkedIn and let’s talk about how I can help you lead with visibility.

🎯 Small-cap visibility and investor trust, powered by storytelling and AI. Connect with Anna Dalaire and follow BullVision Consulting Inc. for more bold, compliant strategies.

📬 Subscribe Clicks & Capital: Your Small-Cap Digital Playbook

Stay ahead with concise, no-fluff insights from Bullvision's capital markets and digital branding experts. Get plug-and-play frameworks, real mine-and-market case studies, and AI-driven visibility audits delivered straight to your LinkedIn inbox. By subscribing, you'll also be the first to learn about our AI tools, designed to save you time and position you as a market leader.

Comments