The CEO’s Social Edge: The #1 Currency Your Small-Cap is Ignoring (Part 1 of 2)

- Anna Dalaire

- Aug 8, 2025

- 5 min read

Updated: Aug 14, 2025

In today’s crowded market, investors are drowning in options. Your company’s most valuable currency isn’t a patent, a project, or even gold.

It’s attention. And no, you can’t buy it in bulk. You’ve got to earn it, daily.

If you don’t have it, another company does, and they’re winning the meetings, the calls, and the capital.

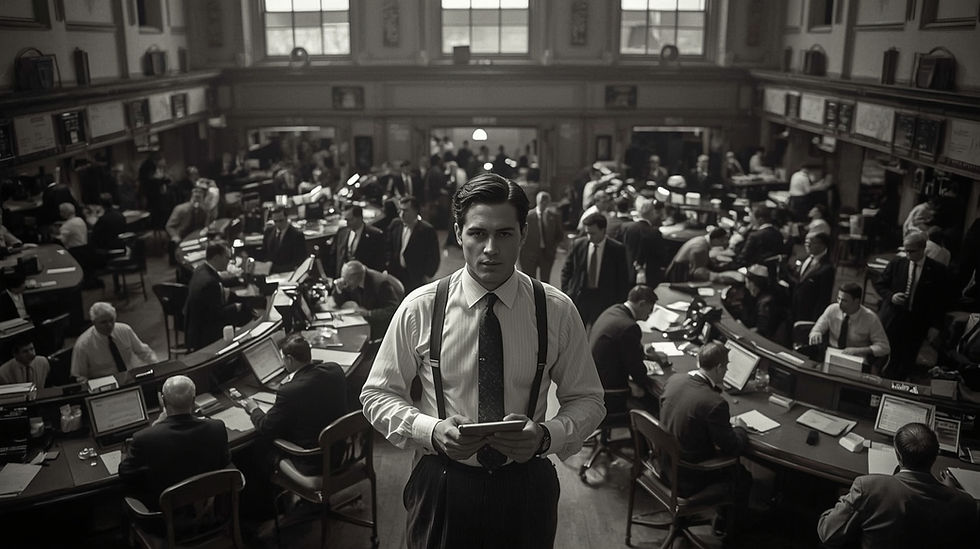

For small-cap public companies fighting to build credibility from scratch, a CEO's LinkedIn strategy can be the difference between being ignored and getting investor calls. It’s how you position yourself at the center of investor attention.

Increasingly, the answer lies with one underutilized asset: your CEO’s LinkedIn profile.

The New Due Diligence: Beyond the Balance Sheet

Gone are the days when investor research meant only reading financial statements and listening to earnings calls. Due diligence is now multi-layered, and LinkedIn sits at the center.

Investors aren’t just scanning numbers. They’re vetting the human element, reviewing a leadership team’s track record, evaluating their network, and getting a sense of “the person behind the performance.” That’s not fluff, it’s part of the risk assessment. An active, credible leader signals execution potential and lowers perceived risk. An absent leader does the opposite.

In small-cap markets, where management strength can make or break an investment decision, this carries real weight. It’s also driving real action: 81% of institutional investors have made investment recommendations based on information they found on social media (J.P. Morgan, 2025).

What was once a niche tactic is now standard capital markets practice, and your CEO’s profile is part of every investor’s due diligence checklist.

Why a CEO LinkedIn Strategy for Small-Cap Companies Beats a Polished Corporate Page

A sleek corporate page is standard. But investors want to connect with people, not logos. They follow leaders they can see, hear, and engage with — not just companies that issue press releases.

And the data proves it:

Companies with visible CEOs get 4x more investor engagement than those hiding behind corporate pages (H/Advisors, 2023).

CEOs who increase their LinkedIn posting frequency see a 39% growth in followers, directly expanding influence (Social Media Today, 2024).

This isn’t marginal impact. It’s exponential.

LinkedIn: The Investor Town Square

With 1 billion+ members, including 65 million business decision-makers, LinkedIn is the largest professional network in the world. For the financial community, it’s also the most trusted digital arena.

Nearly 80% of institutional investors use social media as part of their workflow.

98% of them access LinkedIn at least monthly, and 85% use it weekly.

In 2023, institutional investors ranked LinkedIn the #2 source for investment research — second only to a company’s own investor relations website.

Investors aren’t just browsing. They’re verifying leadership experience, assessing networks, and scanning for signals of competence, vision, and execution.

The Risk of Invisibility

The biggest myth? That staying offline is the “safe” option.

53% of CEOs not on social media have inaccuracies in their online search profiles (H/Advisors Abernathy, 2024).

In small-cap markets, where management quality is often the deciding factor, a silent CEO lets the market fill in the blanks. And markets hate uncertainty. When they can’t verify your competence, they price in more risk, which shows up as a lower valuation or fewer investor calls.

The choice isn’t whether to have a digital presence. It’s whether you control your narrative or let others write it for you.

A strong CEO LinkedIn strategy for small-cap companies also plays a critical role beyond investor engagement, influencing brand perception, media coverage, and recruitment.

Beyond Investors: The CEO as Brand Builder

The upside of CEO visibility doesn’t end with investors:

82% of consumers trust a company more if its CEO is active on social media (DSMN8, 2023).

Strong CEO-led employer branding can cut hiring costs by up to 50% and reduce turnover by 28% (LinkedIn). Employee retention is more than an HR win — it protects institutional knowledge, accelerates project execution, and maintains momentum in projects investors are tracking.

From capital raising to talent acquisition, one leader’s active profile can drive growth across the business.

Why This Works

It comes down to two forces:

The LinkedIn algorithm favors person-to-person interaction over corporate announcements.

Human nature — a CEO celebrating a team win feels more authentic than a generic press release.

That authenticity builds the credibility and the trust that investors crave. Because capital follows confidence. A leader who shows up with clarity and consistency builds trust faster, and trust is the currency that moves deals forward.

Coming Thursday, August 18: Part 2 — “The Executive Digital Playbook.” We’ll dive into investor behavior and share a 3-step framework you can implement immediately.

Subscribe to Clicks & Capital so you don't miss it!

Want to dive deeper into this topic? I will be speaking at the Mining Meets Digital: The Implementation Blueprint event by Umar Rafique on Friday, August 29, 2025, at 8:00 AM PDT.

We'll break down more actionable strategies to get your company noticed by the right investors.

🎯 Small-cap visibility and investor trust, powered by storytelling and AI. Connect with Anna Dalaire and follow BullVision Consulting Inc. for more bold, compliant strategies.

Disclaimer: BULLVISION Consulting Inc. wrote and published this article for informational purposes only. My views are based on my experience in capital markets, communications, and small-cap exploration. While I strive to reference reliable, publicly available sources, I can't guarantee the accuracy or completeness of all information shared. This content is not investment advice, a recommendation, or a solicitation to buy or sell securities. Please do your diligence. Nothing here should be taken as legal, accounting, or tax advice, and I am not responsible for any decisions based on its content. This article is meant for a general audience and may not be appropriate for readers in jurisdictions where such material is restricted.

Sources

Brunswick Group (2023): Digital Investor Survey 2023

Chase: Social media's influence on the investing community

DSMN8 (2023): The Impact Of An Executive Social Media Presence

Financial Advisor Magazine: Advisors, Clients Are Connecting On Social Media

Heitland Media Group (2025): The CEO's Digital Authority Imperative: A Strategic Framework for 2025

Greenwich: Social Media Influencing Investment Decisions

SmartAsset (2022): Financial Advisor Marketing Survey 2022

Comments